COMPAS - UI Tax Audit

COMPAS™ – UI Tax Audit

MTW’s COMPAS product is the only Unemployment Insurance (UI) Tax Audit software application designed specifically to complete and manage the UI-Tax audit process. That means when your audit team uses COMPAS, they will use tools specifically designed to perform high quality audits that pass USDOL Tax Performance System (TPS) Quality Reviews. It also means that your audit team will be using a mature and proven solution that manages and tracks the entire UI-tax audit process and can be leveraged to complete non-audit investigations as well.

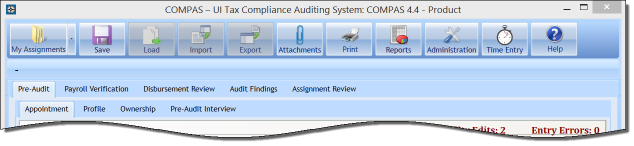

COMPAS is a configurable off-the-shelf Windows® Desktop application built on the .NET framework using a SQL Server database as a central repository. MTW can easily configure COMPAS to meet specific needs of your state agency. As illustrated below, COMPAS has a tab-based user interface that provides step-by-step guidance for novice users or allows advanced users to move through the audit as they choose. Integrated help, reflecting the configuration for each customer, delivers instructions for completing each tab.

Since 2011, the labor/employment agency in 12 states have made the decision to use COMPAS to further automate and improve their UI-Tax audit processes. See how COMPAS can improve your audit processes with these Features and Benefits:

COMPAS FEATURE HIGHLIGHTS

- Audit Library – move and manage audit or investigations with check-in and check-out process

- Work connected or disconnected from the Agency Network

- Pre-audit and Post-audit tools for documenting TPS and agency required actions

- Worksheet format with auto-calculations and carry forward data-entry

- Data encryption ensures maximum security and protection for data on the user’s computer

- Multiple management reports easily accessible including generated ETA-581 data

- Worksheet data Import and Export capability

- Correspondence Generation with merged data

- Built-in Audit Tools: Add Comments/Notes, check TPS edits and maintain a Task List

- Time Entry Log to document time spent on the audit/assignment

- Flexible application to use for alternative audit staff assignments such as investigations and also non-audit staff assignments to document employer Wage Adjustments

- All supporting materials, attachments stored with the audit

- Optional Employer / Assignment Selection function available

- Built-in TPS Review process to allow the agency TPS team to securely review and score the annual Audit Universe audits within COMPAS – isolated from the audit staff through security

- UI Tax Audit functionality adapted to provide the same robust features for PFL auditing

COMPAS BENEFITS

- Save time for auditors, reviewers, and supervisors - Integrated worksheets - Central database stores audit, employer documents, and correspondence and enables automated approval workflow - Tab-based navigation

- Real–time error checking – visibly tracks and displays Quality Edits and Entry Edits to resolve

- Easily integrates with legacy or modernized implementations of UI Tax Systems

- Settings Management feature that allows agency administrative user to manage a number of settings resulting in less dependency on the MTW Support Team

- Ongoing enhancement, maintenance and support provided by MTW that allows all customer agencies to benefit from each other’s ideas and issue resolutions.

- Compatible with Microsoft Windows 10 and 11

How It All Began

Starting in 2009, MTW created COMPAS from the ground up by collaborating with two Unemployment Insurance (UI) Tax audit professionals to develop a software product specifically designed for the UI tax compliance audit process. The driving focus of this internal development project was to create a state-of-the-art software tool to help UI Tax auditors consistently perform quality audits that pass USDOL Tax Performance System (TPS) Quality Reviews. MTW developers worked closely with our UI Tax audit experts for more than a year to create a system that is user-friendly, saves time, and improves the consistency of the audit process for experienced and novice auditors alike.

COMPAS enables state UI Tax audit staff to be more effective and efficient throughout the entire audit process. Auditors receive continuous feedback on their progress toward completing the steps that are required to ensure that they meet USDOL TPS and best practice standards for quality audits.

Implementation and Product Releases

Since our first implementation with the Alaska Department of Labor and Workforce Development in 2011, COMPAS has evolved to meet the varying needs of customers. We release a new version of COMPAS approximately every 18 months. Our current release is 7.1. As our client list has grown, we have expanded COMPAS with a long list of enhancements and features. We have also expanded COMPAS to manage Wage Adjustment, Adjustment No Wage Detail assignments, TPS review, and Paid Family Leave audit. When state agencies select COMPAS, they are choosing the best. We have built a solution that is user friendly, ensures quality investigations and audits; and ultimately saves auditors and management time while maximizing positive results.

You and your UI Tax team can quickly reap all the benefits our customers have by taking the next step to arrange a demonstration of COMPAS and learn how COMPAS can improve your UI Tax audit operations.

Download our brochure to share with your team: COMPAS Brochure.pdf